Dealing with Debt: Implications of Minimum Payments on Credit Card Interest Paid

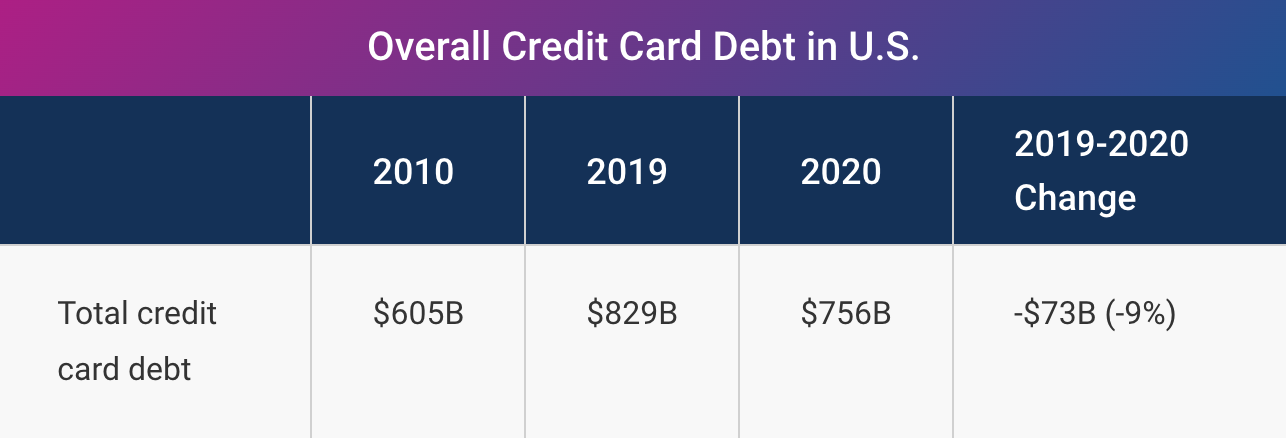

Revolving credit card debt declined during the COVID-19 pandemic, but has just begun to tick back up from 2020 lows.

Source: Experian

For consumers juggling repayment across multiple cards, what’s the best approach to take when paying down debt? Because it can be more motivating to pay off a credit card account in full, consumers tend to repay debts with the smallest balance first so they can close accounts and feel a sense of progress (this is referred to as Debt Account Aversion, named because of consumers’ aversions to having lots of open debt accounts). The most rational approach would involve paying down the highest-interest debt first, as this approach minimizes interest paid. A recent paper by Hirshman and Sussman explores a new question: how do minimum payments influence consumers’ debt repayment strategies across multiple cards?

These researchers hypothesized that the existence of minimum payments imply to consumers that they should be paying more than the minimum, and encourage them to pay more than the minimum across multiple debt accounts, rather than focusing on the highest interest debt. More specifically, they hypothesized that:

- Consumers will make payments that are more dispersed (spread evenly) across debts when repaying credit card accounts with minimum payments.

- The presence of the minimum payment on all cards will decrease repayments to the highest interest rate debt.

- The presence of the minimum payment on all cards will lead to higher interest costs when compared to a no minimum payment control.

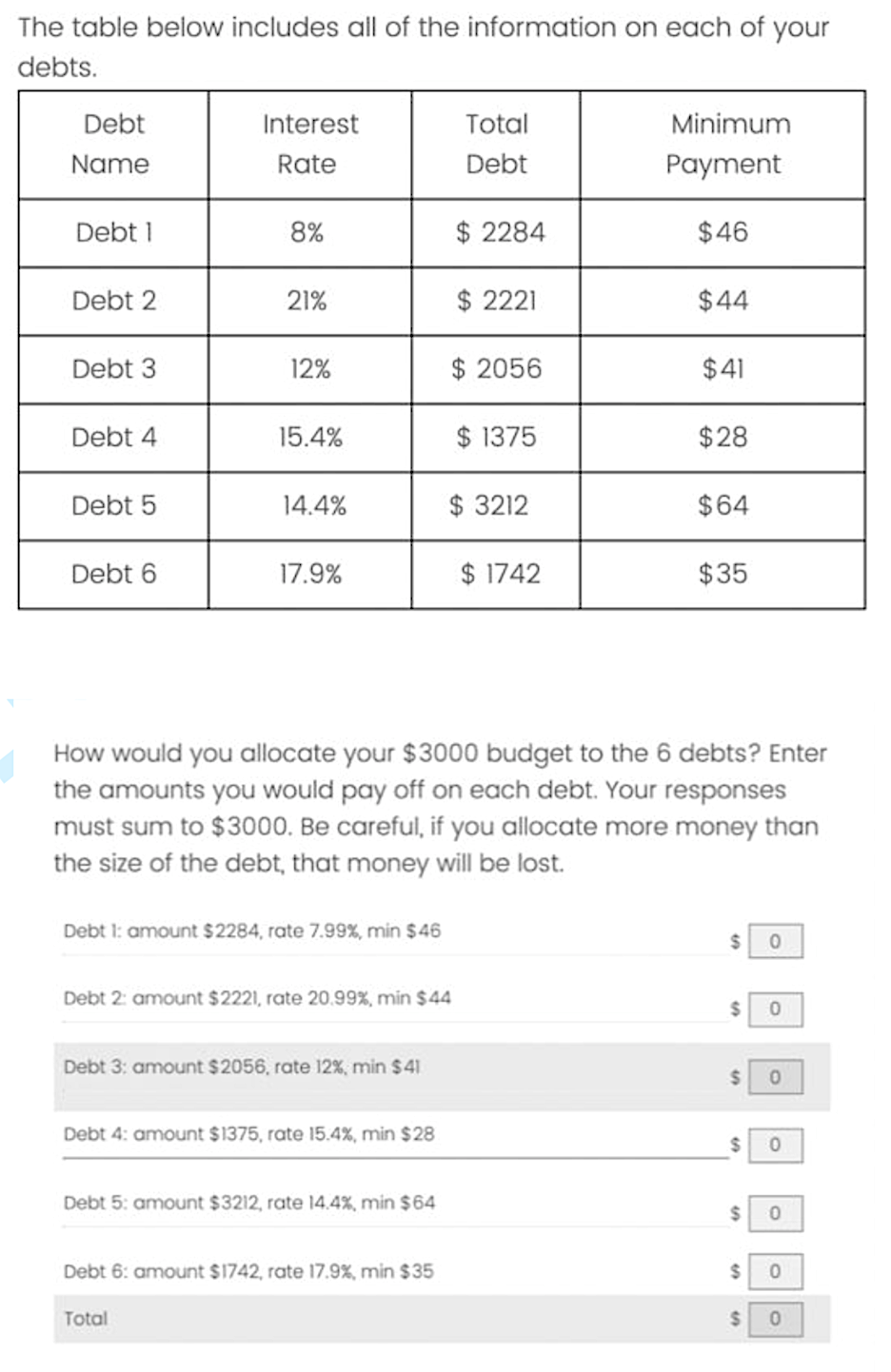

To test these hypotheses, they ran a series of four experiments. In all of the experiments, participants played a debt management game in which they were provided with the interest rates and amounts of six debt accounts of varying amounts. They were given a budget of $3,000 to dedicate to debt repayment (significantly less than the total of the debts), and had to select the amount they wanted to allocate to each debt. They played the game for three rounds, mimicking paying down credit cards over a three-month period.

Experiment 1

In the first experiment, participants were randomly assigned to either a condition with minimum payments (and a $25 late fee) on all accounts or a no minimum payment control condition.

Participants in the minimum payment condition allocated their repayments in a more dispersed way, paid less money towards the highest interest rate debt, and ended up paying more money in interest.

An example of Experiment 1’s interface

Experiment 2

In experiment 1, participants were forced to allocate all $3,000 towards repaying debt. But experiment 2 gave participants in both conditions the opportunity to put some of their budget into a savings account.

Results were consistent with experiment 1. In addition, participants in the minimum payment condition allocated significantly more to savings than those in the no minimum payment control, and were also significantly more likely to allocate any money to the savings account.

Experiment 3

The researchers added a suggested, penalty-free minimum payment condition. To test whether participants in the minimum payment conditions perceived a recommendation to pay more than the minimum amount, participants also responded to questions about their perceived recommendations.

Again, payments in the minimum payment conditions were significantly more dispersed than those in the no minimum payment control. But in the new suggested minimum payment condition, payments were significantly less dispersed than in the required minimum condition. As compared with the control, participants in the required minimum and suggested minimum conditions also responded that they perceived a recommendation to pay more than the minimum required.

Experiment 4

Researchers returned to the setting from experiment 1, but added new conditions that mimic real world decision-making environments:

- High interest salience condition: Sorted debts by their interest rates

- Active choice condition: Provided the minimum payment and full balance as two default options

- Salient interest + active choice condition: Combination of the first two conditions

- Paper statement condition: Attempted to mimic the consumer experience of searching for relevant information in credit card debt statements by partially obfuscating interest information.

The paper statement condition was most costly to participants. By introducing an additional perceived recommendation, the recommendation to pay off debts in full, the active choice condition performed best—significantly reducing the dispersion of payments, and increasing the amount allocated to the highest interest rate debt. The rest of the conditions performed in between these two.

So what?

Hirshman and Sussman demonstrated that minimum payments lead participants to spread their discretionary allocations across more accounts, and incur larger interest costs. They also demonstrated that the information displayed in the decision-making environment has the potential to either exacerbate or mitigate this effect. These findings point to some promising strategies to test in the field, particularly by debt account aggregators:

- Provide recommendations for payment amounts that draw attention away from the implicit recommendation of the minimum payment amount, such as the researchers did when they provided an active choice between the full balance and the minimum payment

- Highlight and sort interest rates of each debt for consumers

- Make minimum payment amounts a less salient part of the allocation decision – perhaps by asking consumers ahead of time how much total money they can allocate to debt repayment each month, and then providing automated recommendations on how to allocate it based on required minimum payments and interest rates

- Automatically funnel extra interest payments beyond the minimum payment to the highest interest debt

This work also highlights the importance of considering the fact that consumers are often juggling multiple debt accounts. Nudges targeted at increasing repayment on individual accounts may not be in consumers’ overall best interest, as it may lead them to incur additional interest costs.

Hirshman SD, Sussman AB. EXPRESS: Minimum Payments Alter Debt Repayment Strategies across Multiple Cards. Journal of Marketing. November 2021. Link: https://doi.org/10.1177%2F00222429211047237

Want to learn more about behavioral design? Join our Behavioral Economics Bootcamp today.