Financial Services

Types of Things We Can Help With

AI Disruption in Fintech: What You Need to Know

Where We're Headed

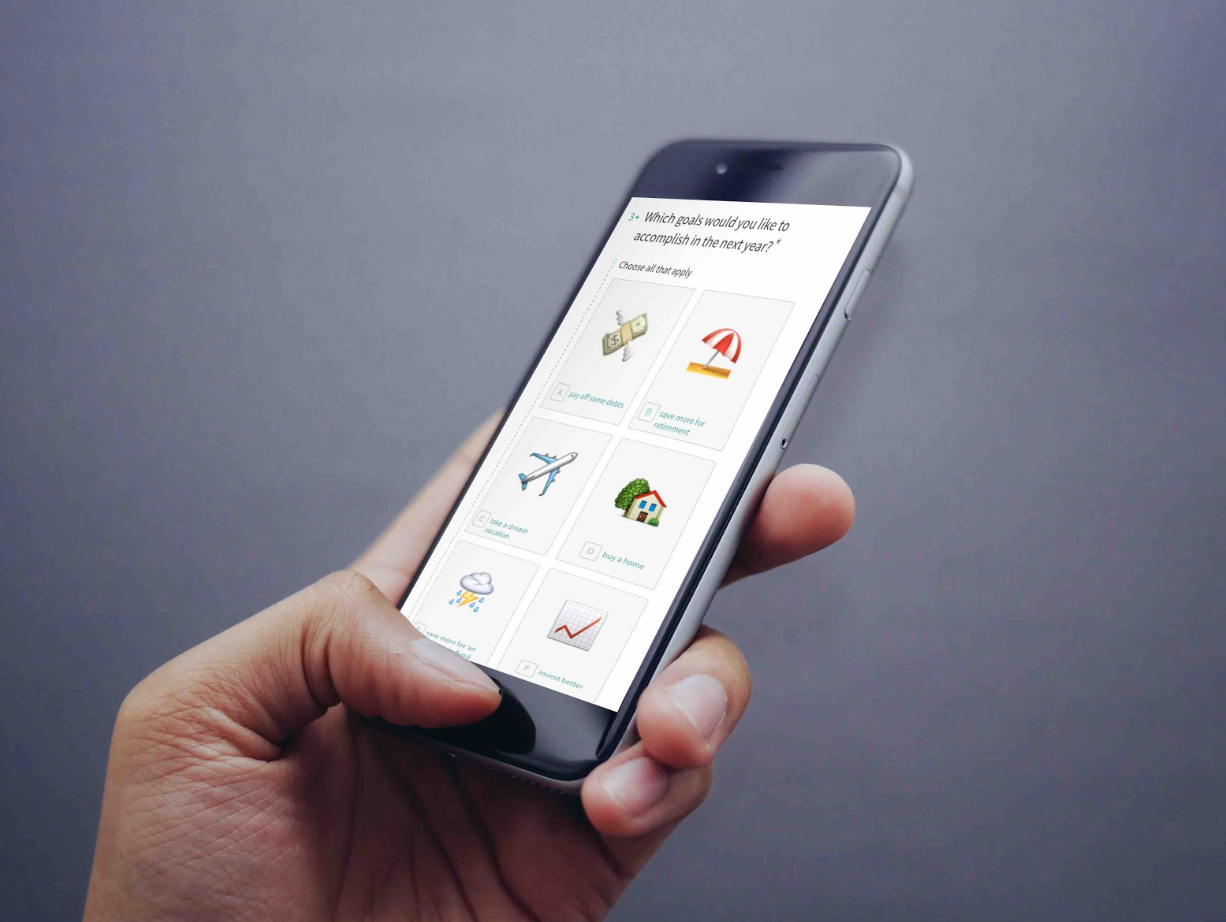

Will AI reduce barriers in financial decision-making and enable more people to better manage their finances?

What We Worry About

Will AI increase bias in lending and enable new forms of fraud? What are the regulatory hurdles?

Who We're Watching

Which fintech players are leading the charge to design for human behavior—while helping us improve our financial health?

Case Studies

We leveraged behavioral design to improve member and product outcomes with Credit Karma Money Spend, Credit Karma’s checking account.

We worked with Steady on the questions: How can we increase engagement? Our experiment drove double-digit increases in bank account linkage.

Enterprise Design & UX Director, American Family Insurance

Perspectives on Finance & Fintech

Fintech? Bank? Tech company rolling out a wallet?

EXPLORE MORE

Our Services

From concept to code, explore how we get our hands dirty with research, product, and marketing challenges.

Our Areas of Expertise

Learn how we are helping change behaviors across the domains of health, education, finance, and more.

Join our Bootcamp

Understand your customers’ choices and learn how to change their behavior for the better — in our 8-week online Behavioral Design course.