How to Boost Product Engagement with the Endowment Effect: A Case Study in Bitcoin

How do you increase the growth of Bitcoin? The cards (or coins) are stacked against you.

Bitcoin is hard to trust. It’s not centrally regulated. Security comes from miners, and the value changes constantly. Nevertheless, 94% of financial advisors say that people ask them about cryptocurrency.

Clearly, people are interested. But what would it take to convert interest to adoption?

To find out, we ran an experiment. Spoiler: it drove a 700% increase in cryptocurrency wallet creation. This is huge – and best of all, it’s scalable across industries, at a cost of less than $0.01 per person.

How did we do it? And how can you apply these insights to benefit your own product?

Overcoming Bitcoin’s Hurdles: The 4 Major Barriers to Adoption

Before designing an experiment, we looked at the existing cryptocurrency landscape to confirm the main barriers preventing mass adoption. We identified four primary barriers for prospective new users that many tech products share:

- Negative mental models: What are the first thoughts that come to mind when you hear the words ‘cryptocurrency’ or ‘Bitcoin’? Most think of the FTX, cybersecurity hackers, or meme-based jokes like Dogecoin. These gut reactions reflect our mental models, i.e. our basic understanding of a product that shapes our motivation to engage with it.

- Ambiguity aversion: Do you know how Bitcoin works, really? All cryptocurrencies are decentralized digital currencies built on cryptography and blockchain technology. Although some people can come up with this description, few actually understand the underlying components at work. The result: ambiguity aversion, or a preference to engage with things we know over things we don’t know.

- Cognitive overload: Starting to learn and make decisions about cryptocurrency is really hard. There are too many options, and introductory articles are essentially written in Greek due to the unique terminology. Prospective new users face cognitive overload – an effect where we are easily overwhelmed by too much or too complex information.

- Logistical friction. Every additional click, step, and decision required to complete an action is cognitively taxing and reduces the likelihood of users continuing. When we streamlined One Medical’s sign-up flow, we increased conversion to bookings by 20%.

Given these barriers, it’s a small miracle that cryptocurrency has grown to its current size. But it’s also not surprising that it hasn’t achieved mass adoption. There’s just too much friction.

How We Increased Adoption

If we could lessen the cognitive or logistical friction of purchasing crypto, we would. Reducing friction is usually the simplest way to drive behavior change.

But it turns out that getting a crypto wallet is just hard and hard to change. So we had only one lever: increase someone’s motivation to get crypto.

How do you do this?

Enter: The endowment effect.

The endowment effect is our tendency to value things we own more highly than equivalent things we don’t own. It’s old – as old as our evolutionary ancestors the apes 5 million years ago.

Consider the classic study that asked students to choose between a mug and chocolate for participating. 50% choose mugs and 50% choose chocolate, with one exception: when they were given a mug first and then asked if they wanted to swap it for chocolate (they didn’t). Likewise, when people were given chocolate first and then asked if they wanted to swap it for a mug, they said no. Most chose to keep their initial item.

And it’s not just mugs. In past research at Irrational Labs, we found the endowment effect to be tremendously impactful, even as a light-touch intervention in a hard market like healthcare. Normally, healthcare benefits are presented in a ‘gain frame’: you can sign up for this benefit if you want. Re-framing an email’s call-to-action to remind the recipient that the healthcare benefit was already theirs increased Livongo’s registration rate by 120%.

Because of this success, we hypothesized that endowing everyday investors with a small amount of Bitcoin – the best-known and most popular cryptocurrency – would motivate them to create a crypto wallet and learn how to use it. Adoption, we posited, would increase – despite the behavioral barriers.

The Satoshi Experiment: Sparking Wallet Creation With Micro-Endowments

To test this approach, we needed to give people Bitcoin and then see if having it (endowment) would motivate them to open up a crypto wallet.

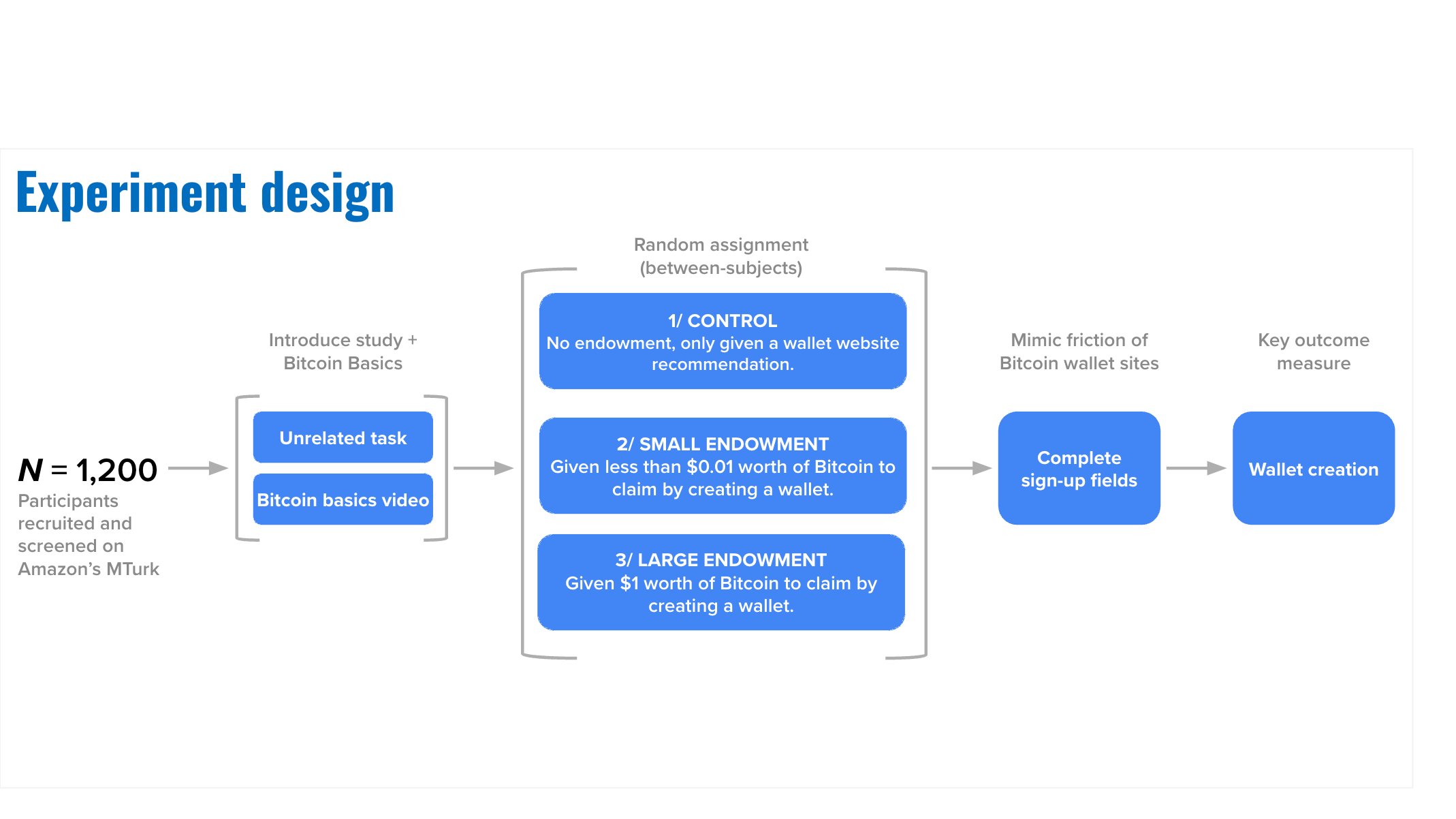

To do this, we recruited 1,200 Americans with no previous Bitcoin or cryptocurrency ownership and split them into groups.

We gave one group a miniscule amount of Bitcoin (1 Satoshi, or $0.0003) and put it into a free crypto wallet. The Bitcoin was theirs; they only had to open the wallet. For a second group, we just educated them about the free wallet and told them they could buy Bitcoin when they opened it. Just to keep things interesting, we added a third group. For them, we put slightly more Bitcoin into a wallet, but still a very small amount (3,600 Satish, or around $1).

Opening a crypto wallet is not easy. There are multiple steps and verifications to go through. Would the Satoshi be enough motivation to get them over the hump of all this friction? Our team was skeptical going in. After all, the Satoshi was such a small amount of money – less than 1 cent for some people!

The Big Insight: Endow People with Your Product

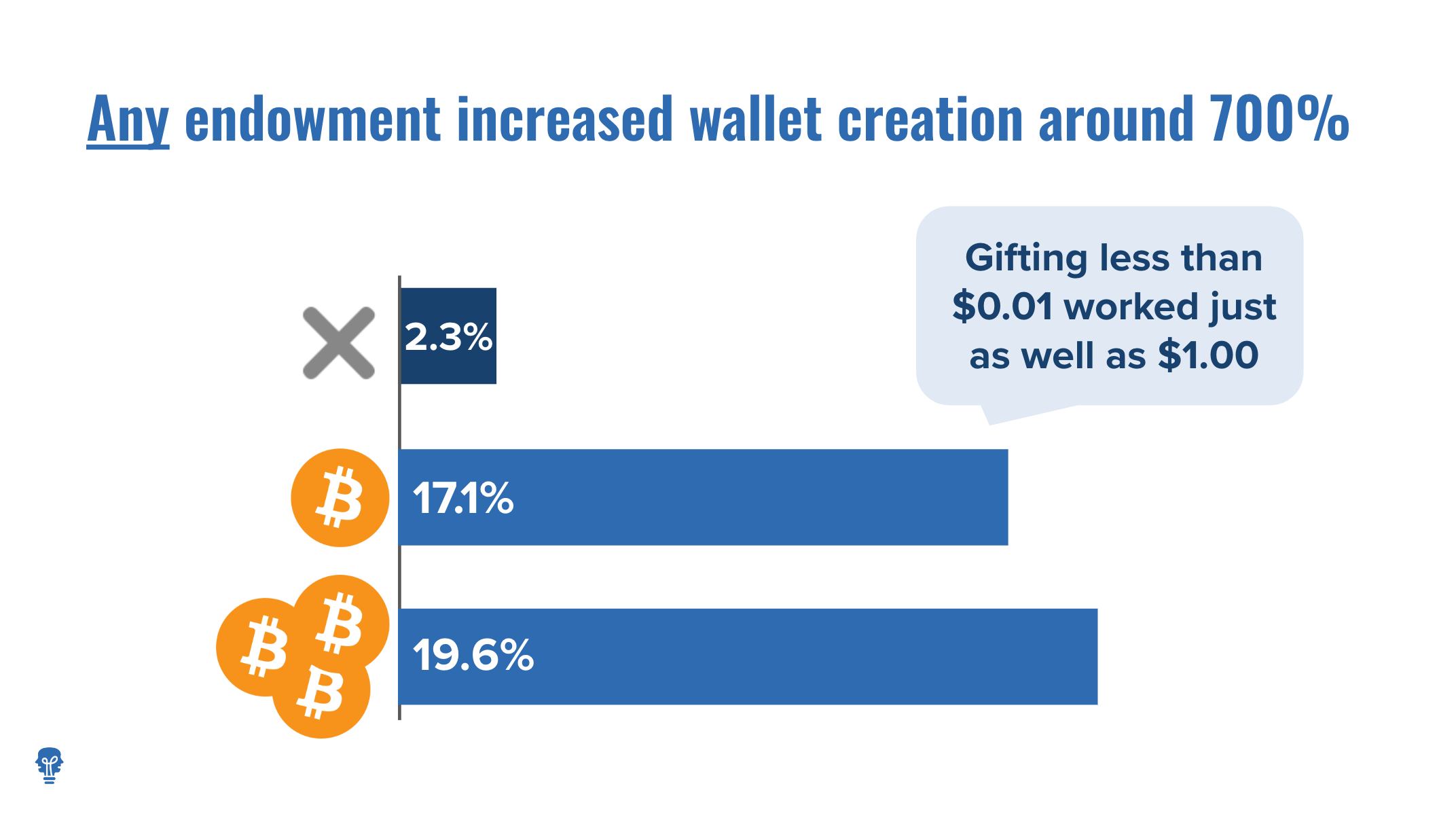

The endowment worked. Endowing participants with a small amount of cryptocurrency vastly increased wallet creation (700%!).

More surprisingly, there was no statistical difference between the small and large endowment conditions. This means people weren’t just after the money. Even an endowment of practically zero monetary value motivated wallet creation.

You Don’t Have to Give it Away

Our intervention worked so well because it made people feel like they already owned Bitcoin, even before they had opened a wallet. Perceived ownership underlies the endowment effect in motivating behavior, beyond actual ownership or physical possession.

What does this mean if you work in product or marketing? You can help people feel like they own your product even before they actually have paid you! This could drive motivation to actually pay you.

Here a some examples of products leveraging initial endowments:

- Warby Parker gives new customers a free home try-on – the ability to test 5 different styles shows the company will sacrifice to help users find the right option for them.

- Salesforce Starter offers a time-limited, risk-free trial – 30-days of access to platform features to experience the benefits personally, without thinking about payment (no credit card needed). Yes, free trials can create endowment.

- Tinder awards a limited amount of a premium feature – 1 super-like per day excites users with an increased chance of being seen and matching with someone.

- Pearl Resorts surprises customers with a free gift – a water bottle positively associates the company with sustainability and reminds visitors of their experience after leaving.

Boost Perceived Ownership

- SleepNumber renovated showrooms share an interactive demo – personalized insights like pressure points and a preferred sleep number setting increase perceived ownership.

- Pete & Pedro lets visitors try to ‘win’ a mystery discount – developing a sense of agency from selecting a mystery discount and winning increases user motivation to claim and use the endowed reward.

- Adidas, Amazon, and many others allow virtual product testing – AR lets customers visualize ownership by bringing products into their world, without visiting a store.

Boost Perceived Ownership Using Generative AI

- Wayfair Decorify spurs customers’ imaginations – uses Stable Diffusion to create shoppable redesigns of user spaces – either via image upload or Apple Vision Pro.

- Google enables customized visualization – generative AI displays products on a wide variety of body types and skin tones to increase confidence in shopping selections.

- Our own research at Irrational Labs found replacing product quizzes with an AI chat increased trust and conversion by reflecting user responses in the recommendation.

4 Ways Your Product Can Use the Endowment Effect

Whether you offer a physical or digital product, the endowment effect can help you boost adoption without costing you a lot of money.

- Free trials: Invite new users to experience your product, or one of its key features, before purchasing.

- Samples: Make it easier for people to visualize your product in action, in their own worlds.

- Mental Models:: When applicable, remind users that the product is already theirs and they just need to activate, or ‘claim ownership’, of their product experience.

- Gifts: Gift them a small thing that motivates them to start: ‘Hi, here’s a $5 credit you can use.’

Remember: customer behavior is complex and always full of surprises. Stop relying on what customers tell you and, even if you aren’t yet a full-fledged behavioral product manager, you can start experimenting to see what actually influences their decisions.

Next Steps: Elevating Your Product with Behavioral Insights

- Start thinking like a behavioral scientist: Kristen Berman’s 5-minute Product Teardowns

- Learn approaches to product experimentation: 3 Product Design Experiments You Can Replicate From Credit Karma

- Learn more about the science of user engagement: Bringing Users Back to the Forefront: 3 Sustainable User Engagement Tips from Behavioral Science

- Solve retention to avoid losing new users: Belong Health Case Study: Increasing Patient Engagement Using Behavioral Science

Want to learn more about behavioral science – and how it can drive product success? Check out our Behavioral Economics Bootcamp today.