This project is a part of Duke’s Common Cents Lab and is generously supported by MetLife Foundation. Common Cents Lab works to increase the financial health of low-to-moderate-income Americans. This project was led by Irrational Labs’ Richard Mathera.

Background

Locked savings products have shown impressive results outside of the US in not only increasing savings but also investment and income. Simple wanted to explore developing a time-locked savings product. The easiest thing for them to do would be to launch a certificate of deposit (CD).

In the US, most time-locked savings products are called certificates of deposit (CDs). We hypothesized that locked savings products in general are less popular in the US than they could be based solely on the mental models that people have of CDs. We designed and launched two separate survey experiments to test this hypothesis.

Our results inform not only the positioning for Simple’s next financial products, but how banks overall should create new locked saving opportunities for customers.

Key Insights

Our hypothesized mental models around CDs included the following views:

- CDs are antiquated products popular one or two generations ago, not modern financial products;

- CDs are bad investments because:

- CDs have limited upside value;

- CDs have low interest rates;

- CDs are associated with a negative framing in which they prohibit you from accessing your money, rather than allow you to fight present bias by keeping money from yourself until you really need it.

Experiment One

In the first experiment, we named a fictitious “Super Locked Savings Goal product” which would have no negative mental models attached to it and compared it to a “Certificate of Deposit (CD).” We also wanted to test the impact of an explicitly declared 2.5% interest rate compared to the value proposition of being able to “lock money away from yourself.”

Condition 1: An online bank is offering a Certificate of Deposit (CD) in which you can earn a 2.5% interest rate if you keep money in it for 6 months.

Condition 2: An online bank is offering a Super Locked Savings Goal product in which you can earn a 2.5% interest rate if you keep money in it for 6 months.

Condition 3: An online bank is offering a Super Locked Savings Goal product in which you can lock money away from yourself for 6 months.

We designed 2 primary dependent variables of interest:

- How likely are you to put money into this product [slider from 0-100]?

- If you used it, about how much money would you expect to put into this product [open text field]?

We ran the experiment with 290 Americans representative of the US population, randomizing each respondent into one of the three conditions.

Experiment One Results

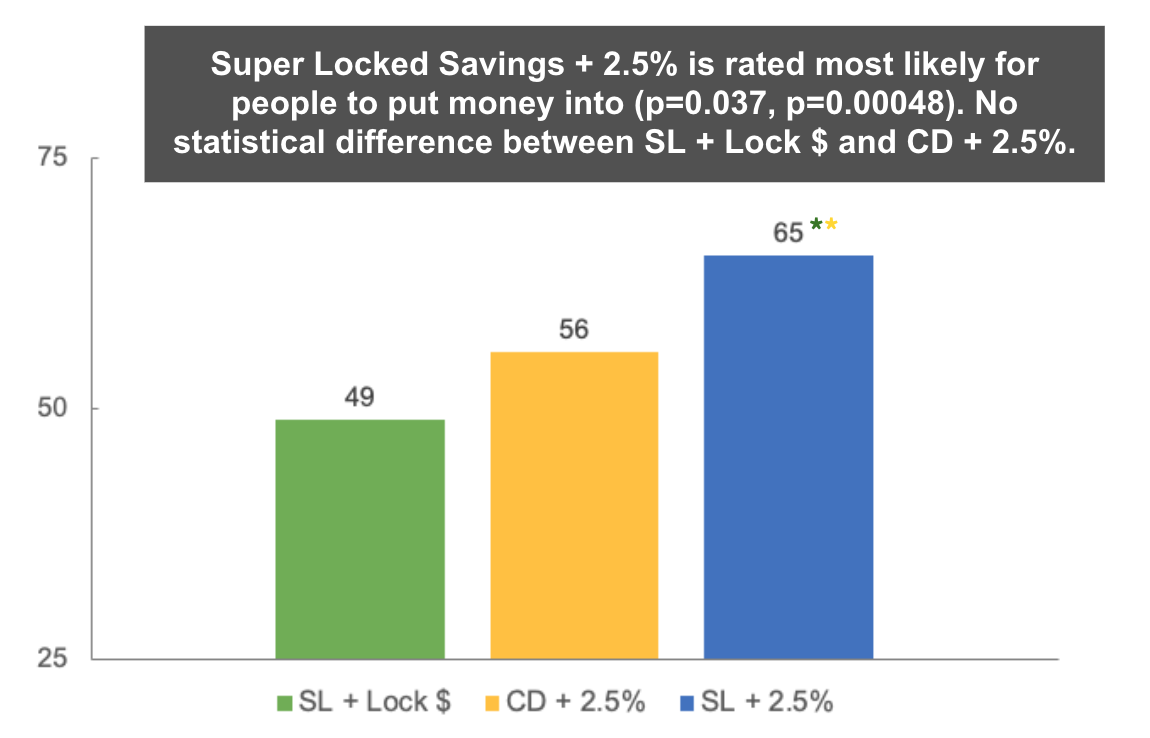

People rated the Super Locked Savings Goal product + 2.5% interest rate the product most likely for them to put their money into (65/100), compared to both the CD + 2.5% (56/100) and the Super Locked Savings Goal product + “lock money away” (49/100). There was no statistically significant difference between the other two conditions.

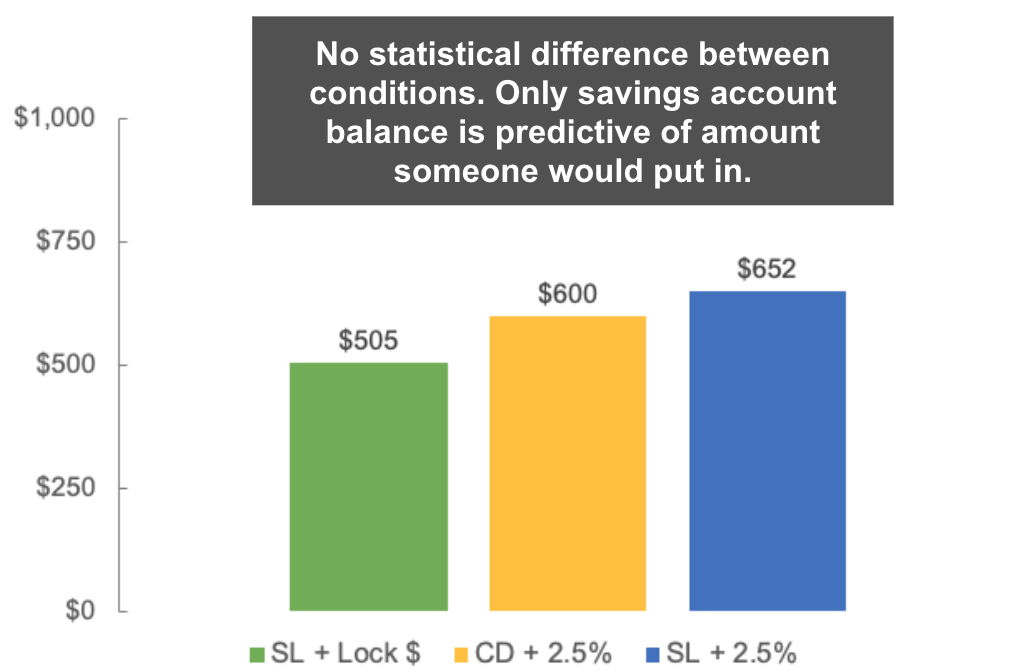

There was no statistically significant difference between conditions in terms of how much money people said they would put into the products. Savings account balance is predictive of how much money people say they would be willing to put into a product, while checking account balance is not.

Overall, our hypothesis of negative mental models unfavorably impacting CDs is supported. To explore this idea further, we designed a second experiment with Simple’s customers.

Experiment Two

In the second experiment, we continued testing our fictitious “Super Locked Savings Goal product” without associated mental models compared to a “Certificate of Deposit (CD).” Since the 2.5% interest rate condition outperformed the “lock money away” condition, we also tested the impact of a meaningful, but feasible, interest rate change for both products (2.0% vs. 3.0%).

Condition 1: Simple is offering a Certificate of Deposit (CD) in which you can earn a 2.0% interest rate if you keep money in it for 6 months.

Condition 2: Simple is offering a Certificate of Deposit (CD) in which you can earn a 3.0% interest rate if you keep money in it for 6 months.

Condition 3: Simple is offering a Super Locked Savings Goal product in which you can earn a 2.0% interest rate if you keep money in it for 6 months.

Condition 4: Simple is offering a Super Locked Savings Goal product in which you can earn a 3.0% interest rate if you keep money in it for 6 months.

We used the same 2 primary dependent variables of interest:

- How likely are you to put money into this product [slider from 0-100]?

- If you used it, about how much money would you expect to put into this product [open text field]?

We ran the experiment to a panel of 344 Simple customers, randomizing each panel respondent into one of the four conditions.

Experiment Two Results

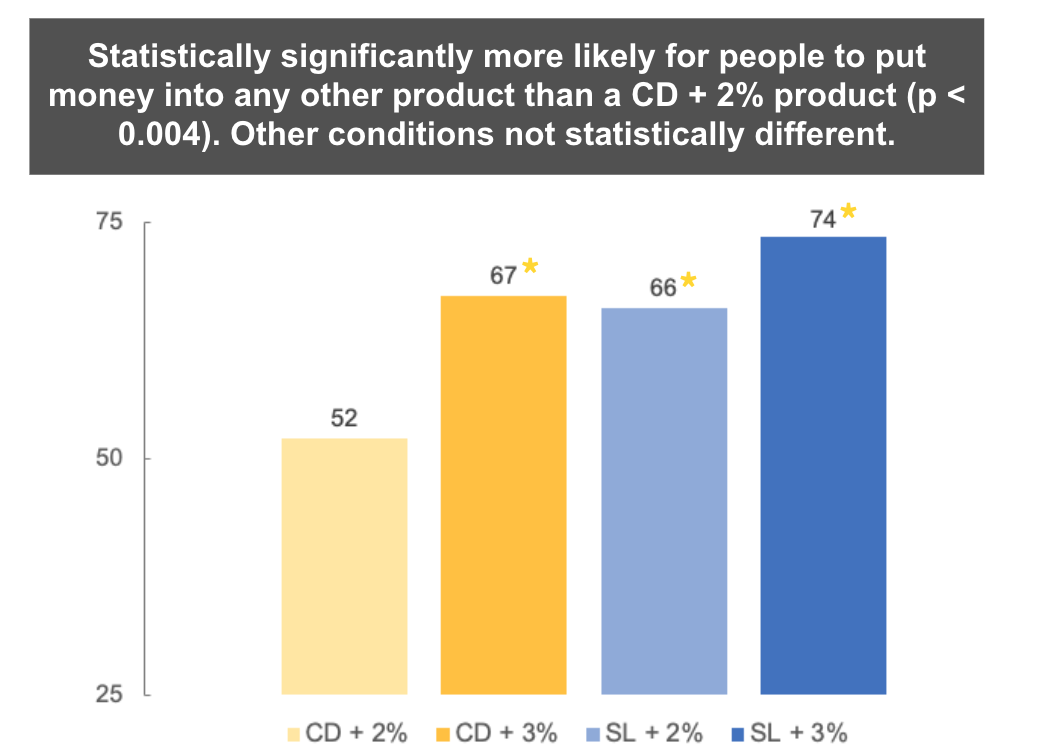

People rated the CD + 2% the product they were least likely to put money into (52/100). The other conditions were not statistically significantly different from one another. We also observe two important main effects, discussed below.

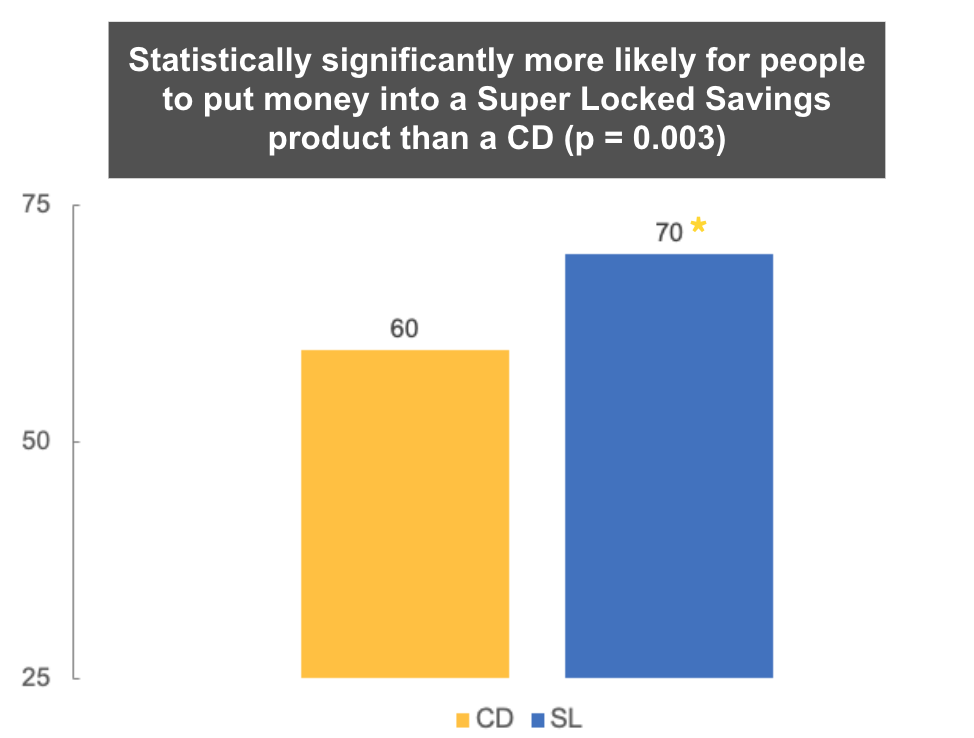

The first main effect compares the “Super Locked Savings Goal product” and the “Certificate of Deposit (CD)” across conditions and finds that again the “Super Locked Savings Goal product” (70/100) statistically significantly outperforms the “Certificate of Deposit (CD)” (60/100) in terms of how likely people were to put money into it, re-affirming the results of our first experiment.

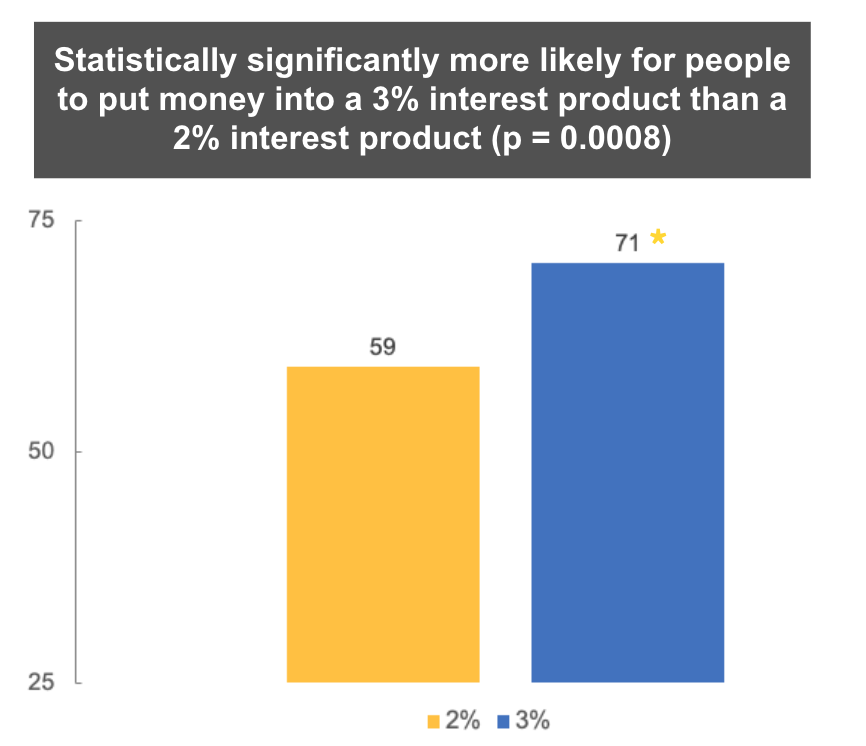

The second main effect tested was the 2.0% vs. 3.0% interest rates, where we found that people were statistically significantly more likely to put money into a 3.0% interest rate product (71/100) than a 2.0% interest rate product (59/100).

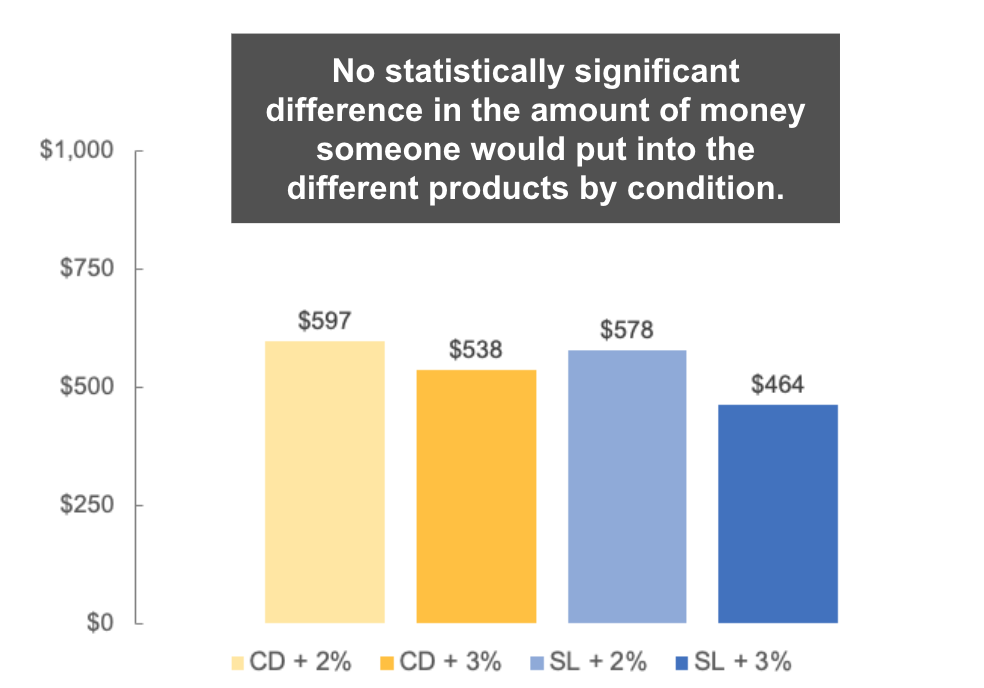

We also examined the differences in how much money people said they would put into each condition and, as in the first experiment, found no statistically significant differences across conditions and found no statistically significant main effects. Again we found that savings account balance was statistically significantly predictive of the amount that people reported they would be willing to invest in any of the conditions.

Also of note, given the similarity of the effect sizes for the two main effects analyzed, the second experiment provided some sense for the relative impact of creating a CD compared to a “Super Locked Savings Goal product” in terms of price/interest rate.

- CD -> Super Locked [60 -> 70]

- 2% -> 3% [59 -> 71]

Overall, both the first and second experiments support our hypothesis that CDs have negative mental models associated with them that may be negatively impacting locked savings in the US. This research shows that framing these products differently could help create increased uptake of products that help people save money more effectively.

Keywords: mental models, saving, experiment, framing