How Do You Increase Sign-Ups If Your Funnel is Very Long?

This project is a part of Duke’s Common Cents Lab. The Common Cents Lab is funded by the MetLife Foundation and supported by Blackrock as part of BlackRock’s Emergency Savings Initiative.

The Long, Broken Funnel for Crowdfunding Small Business Loans

For the 33 million small businesses in the U.S., reliable access to capital and affordable loans is vital to their success. Kiva U.S. is a social impact nonprofit that crowdfunds interest-free loans for exactly this purpose, and they wanted to increase the number of small businesses they were funding.

In 2016, they partnered with Common Cents Lab, a Duke University initiative co-led by Kristen Berman, Wendy Da La Rosa and Mariel Beasley, to do just that. The result? At least 12% more small business owners received 0% interest loans.

The Challenge: Barriers in the Sign-Up Flow

When the team at Common Cents Lab went through Kiva’s application flow and analyzed conversion data at each step as part of their behavioral diagnosis, they found that it was filled with unnecessary barriers.

To qualify, applicants were asked to provide detailed financial and accounting data, pictures, social media information, and more—eight pages in all. Not surprisingly, many businesses started the application but fell off during the process.

Kiva loans were virtually free (save the time to apply), yet the conversation rate was just 20% completed applications. How could this be?

The Approach: Solve for Social Desirability, Time Discounting, and Procrastination

The Common Cents Lab team hypothesized what was happening

- Desire for perfection: Applicants were asked to describe their business, post pictures, and provide social media info. And how they did this could have made the difference between qualifying for a loan and not. As a result, applicants wanted to look good. This is commonly called the social desirability effect and it drives us to prioritize how we look in front of others—in this case, maybe even more than, say…completing the application.

- Procrastination: Because of this desire for perfection, applicants delayed finishing their application. They had the intent to upload the optimal picture and info, but life got in the way. They took a break, planning to return, but never did.

As behavioral scientists, we know that when people look at the future, they don’t always fill in the details. This creates a mistaken perception that their future schedule is clear and free.

What’s more, future time commitments often feel less difficult than current ones—a tendency called time discounting. If you’ve ever scheduled something for ‘next week, when things calm down’ only to find that next week is just as busy, then you know the feeling.

The Experiment: Force a Deadline

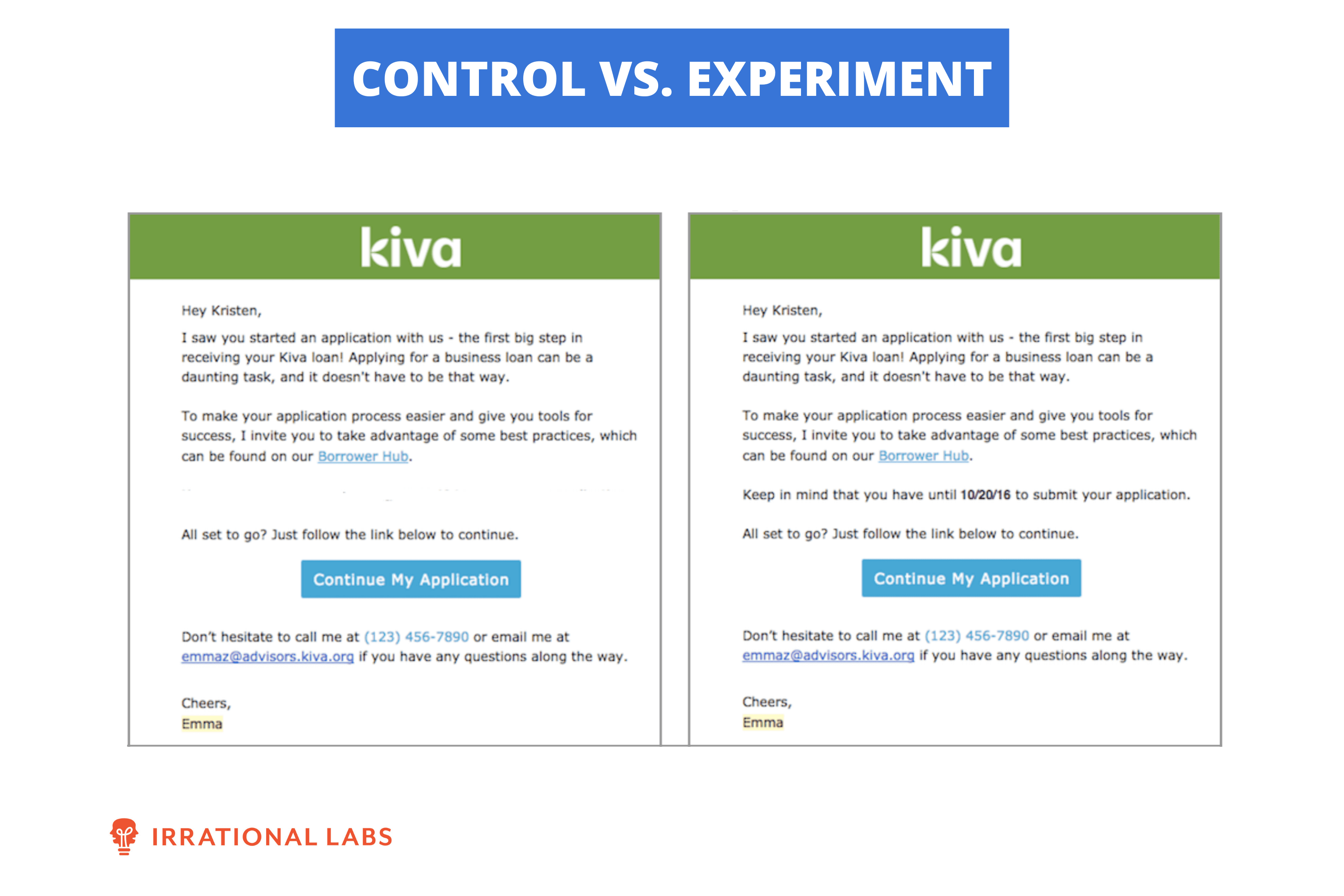

To test these alternative hypotheses, the team created a short email experiment where applicants received one of two emails: one with a deadline and one without.

If the process required a small business owner to invest significant amounts of time, then adding a deadline should decrease the number of applicants. People just won’t have time to fill out the forms and they would miss the cutoff date.

If the process required a small business owner to invest significant amounts of time, then adding a deadline should decrease the number of applicants. People just won’t have time to fill out the forms and they would miss the cutoff date.

However, if people instead forget to complete it or are procrastinating, the deadline would be a helpful way to clarify their thoughts, create an action plan, and complete the application.

So what happened?

The Results: A 24% Lift in Conversions on Applications for Small Business Loans

The results were clear: the deadline condition received 24% more completed applications than the control. The experiment resulted in at least 12% more small business owners receiving a 0% interest loan.

These results suggest that these new Kiva U.S. customers didn’t require significant amounts of time to complete the application; they just hadn’t prioritized it. The majority of tasks we procrastinate on are usually high in immediate costs and low in immediate benefits, making them unattractive in the short run. But what happens if you introduce an immediate benefit?

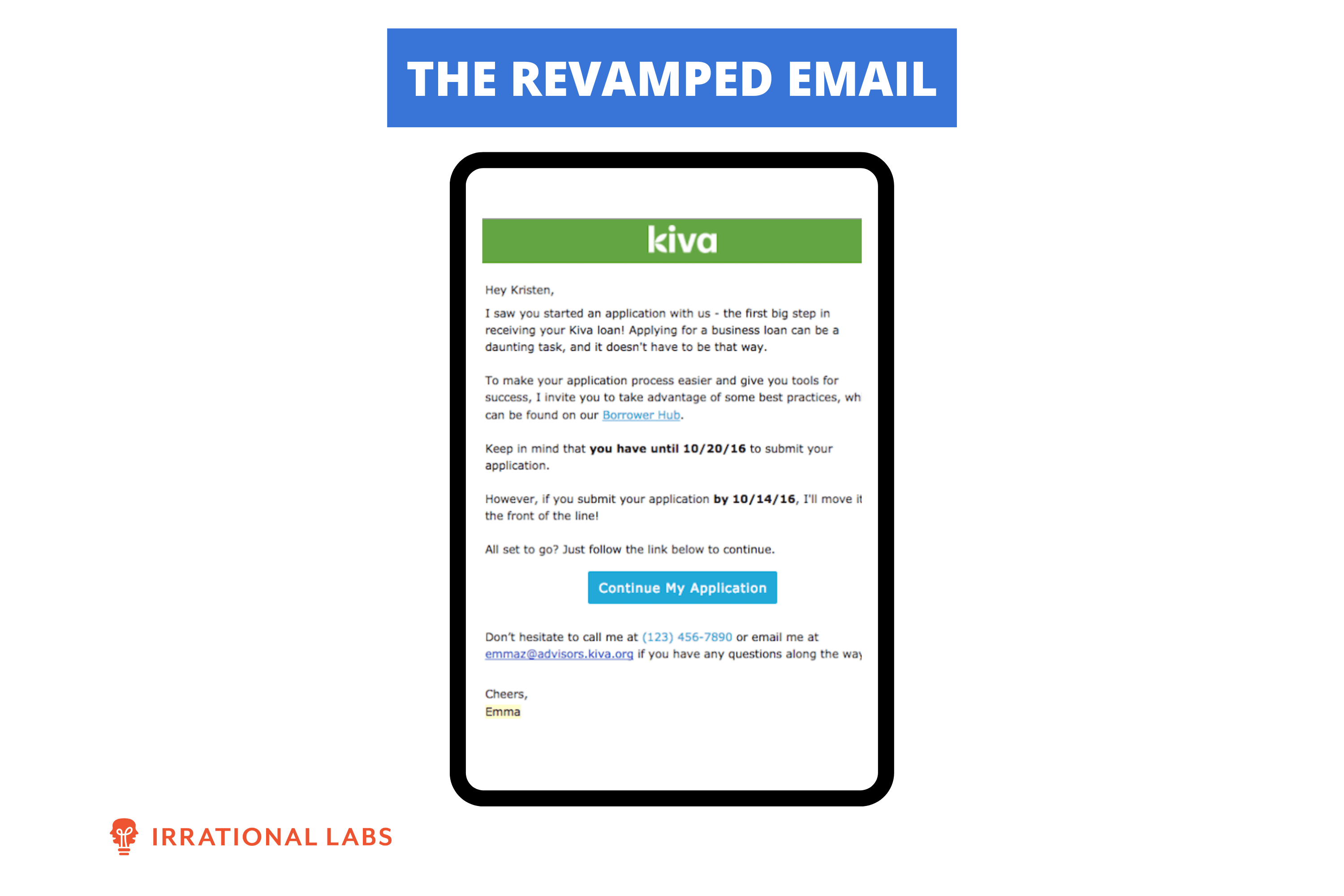

Further Intervention: Combining Deadlines With Rewards

For the next test, the team did just that. They incentivized even earlier completion by pairing a new, earlier deadline with a benefit. If applicants submitted a week earlier than the final deadline, they were moved to the front of the line. Instead of punishing lateness, this intervention rewards the early bird.

This combination of deadlines and rewards increased completed applications by an additional 26% over the single deadline condition.

Kiva U.S. Case Study: Key Product Takeaways

Sometimes less really is more. By introducing deadlines and incentivizing applicants to complete their applications in less time, Kiva U.S. can now fund hundreds more small businesses in the future.

Together, these small interventions led to more than $190,000 in additional credit to LMI small business owners. Made possible with the power of behavioral science.

Want to learn more about this work, or to partner with us to leverage behavioral science to solve your toughest financial services or other product problems? Contact us at [email protected].