Accelerating Loan Repayment Through Behavioral Insights

This project is a part of Duke’s Common Cents Lab. The Common Cents Lab is funded by the MetLife Foundation and supported by Blackrock as part of BlackRock’s Emergency Savings Initiative.

The Challenge: Loan Repayment Pays Off—But Not Today

When times are good, money is cheap. And so are your loans. You can get away with paying the minimum amount. But as any financial adviser will tell you, paying the minimum on your credit card or loan payment isn’t always sage advice—especially when interest rates are higher.

While repaying a loan faster may be a sensible financial goal, it’s also a behavioral challenge: making immediate sacrifices that only pay off in the long run.

It’s a challenge worth addressing. For many Americans, housing costs are a major financial strain. In fact, 2020 census data showed that 46% of renters and 28% of homeowners are ‘housing burdened,’ meaning they spend at least 30% of their income on housing costs alone. And the average mortgage balance is $323,780 with an interest rate of over 6% on a 30-year fixed loan. By paying just $25 extra per month, you would save over $15,000 in interest and pay off your loan a full year sooner.

That’s why EarnUp, a fintech platform that helps homeowners pay back their mortgages by timing their payments with their paydays, partnered with Common Cents Lab.

The team worked with EarnUp to design an experiment that leveraged mental accounting and how people already think about their finances to help them pay down their loans faster. And it worked. We were able to get more people to overpay their mortgage by changing customer emails in one simple way: asking them to round up.

The Approach: Accelerate Repayment by Rounding Up

By running a behavioral diagnosis that included an end-to-end audit of EarnUp’s sign-up process, interviews, literature reviews, and archival data analysis, we found that some customers were already paying more than their required mortgage payment. These overpayments were systematic—the result of rounding to the nearest $5 or $10.

Why? Because people are drawn to round numbers, especially in financial and goal-setting contexts.

So we asked the question: can we leverage this behavioral insight to increase payment amounts?

The Experiment: A/B Testing Email Prompts

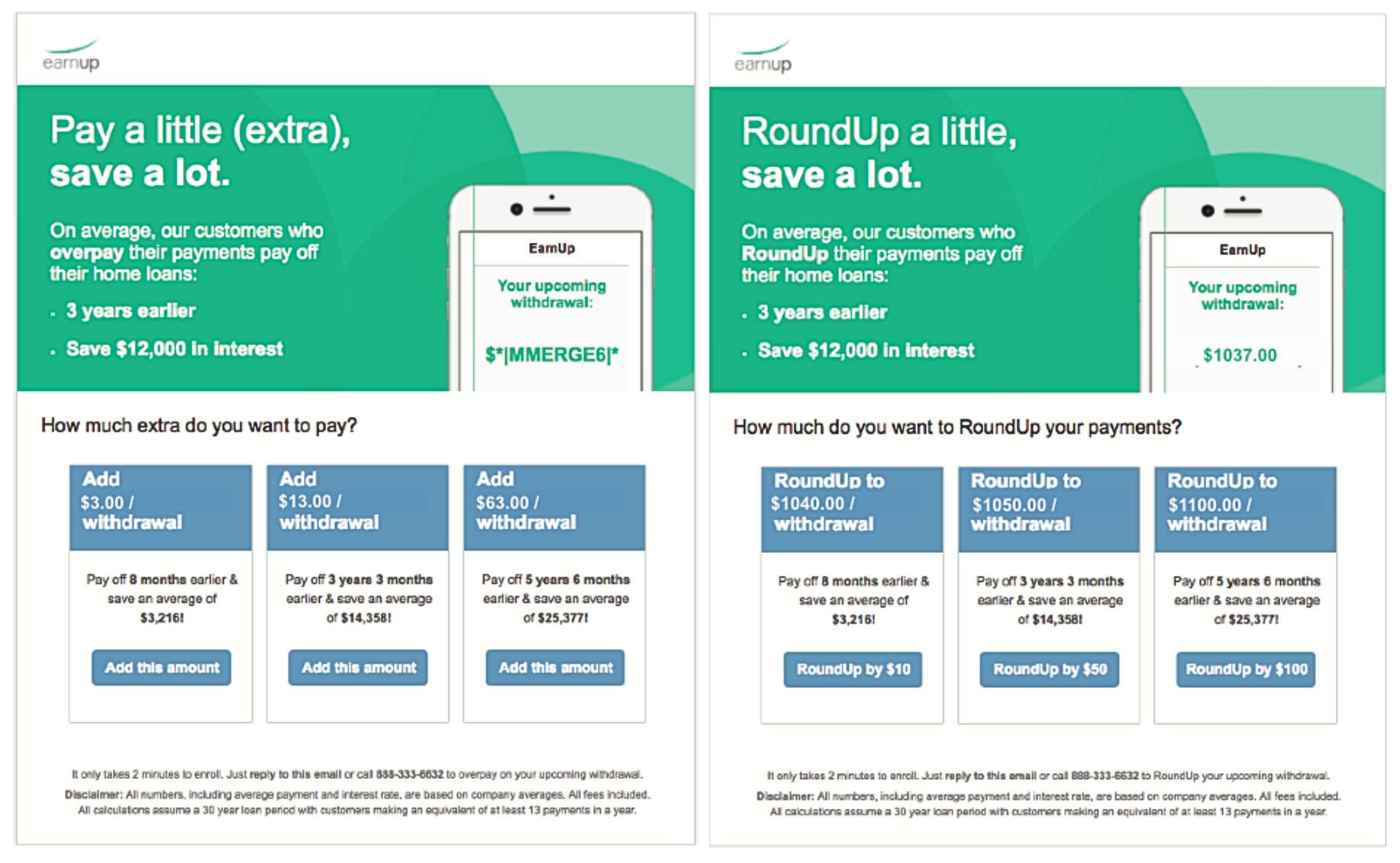

To answer this question, we designed two email messages and randomly assigned people into either ‘Add’ or ‘RoundUp’ conditions.

The emails for each condition were virtually identical except for their slogan, question, and how payment options were presented. And in both conditions, eligible users received an email that included how much the average EarnUp customer saves when they overpay their loan, their next payment amount, and a prompt to either reply to the email or call EarnUp to start overpaying.

The key difference? How the overpayment was framed. In the ‘Add-on’ condition, users were simply prompted to overpay. While in the ‘Round-up,’ they were prompted to round up their monthly payments to the nearest $5 or $10.

The Results: Loan Repayment Accelerated

In the ‘Add-on’ condition, 10.8% of people indicated that they wanted to increase their payment.

But in the ‘Round-up’ condition, when people were asked to round up, 14.6% of people answered affirmatively. Even more impressive? 72% of these overpayers were new—they had never made overpayments before.

3 Key Takeaways from Our EarnUp Case Study

- Do what people are already doing and make it easier. People like to round up. We leveraged this intent and made it easier for them to do it.

- Just ask! A simple prompt to increase regular payments influenced 10% of people to make a change. And framing that question in a psychologically appealing way—the way people already think about money—made it even more likely.

- People really do like round numbers when it comes to budgeting. If you’re a fintech trying to help people deal with money, remember: it pays to round.

Want to learn more about this work, or to partner with us to leverage behavioral science to solve your toughest financial services or other product problems? Contact us at [email protected].