This project is a part of Duke’s Common Cents Lab and is generously supported by MetLife Foundation. Common Cents Lab works to increase the financial health of low-to-moderate-income Americans.

Keywords: Behavioral economics, behavioral design, retention, engagement

The Challenge

Moneymap is a company aimed at increasing financial wellness for employees. Their primary product was a retirement-planning service that was sold to financial advisors.

Retirement planning is a crucial aspect of a person’s financial well-being, but it’s not the only aspect. While the service itself was successful, there was a lot lacking in MoneyMap’s overall product offering. They weren’t helping advisors manage the numerous other aspects of their clients’ financial lives. In order to gain more traction in the financial services market, Moneymap wanted to pivot their business, so they called in Irrational Labs to work with their team to redesign their core product.

Process

We went through our behavioral design process with Moneymap, from putting together a behavioral diagnosis and identifying barriers and benefits present to running an experiment and testing out different solutions.

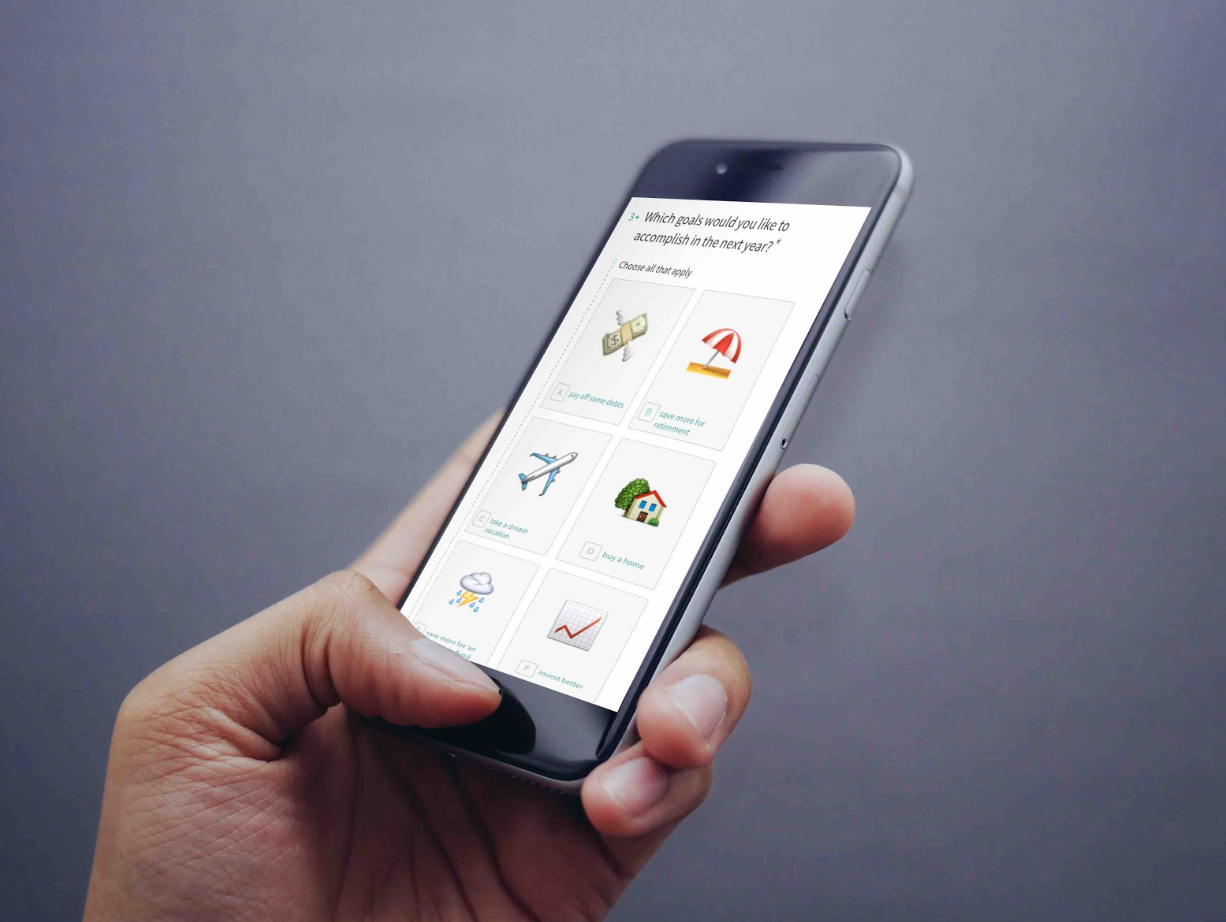

Using quantitative and qualitative research, we tested three different concepts to drive financial health among MoneyMap customers.. Each concept leveraged behavioral insights in a slightly different way. Through the implementation of a/b testing and design iterations, we landed on a final concept centered around robo-financial-advising with an emphasis on the following behavioral science principles:

- Accountability

- Goal Creation and Progress

- Confidence

- Mental Accounting

In collaboration with Moneymap, we then designed an 8-week program for customers that included a call with a real human followed by behaviorally-informed communications via email and SMS.

The core of the product leveraged our deep knowledge of human psychology. Habits, for example, are hard to break and hard to form. It’s easier to get someone to take action one time than to get them to do it repeatedly. So, companies should strive to create one-time behaviors that will trigger the same behavior change as a sustained habit. As a result, whenever possible, the Moneymap platform emphasizes “one-time” behaviors—versus habits—that people can do to improve their financial lives, like setting up an automatic monthly transfer to a savings account.

Within the Moneymap platform, we pushed people to take a one-time action and design their bank account structure once in order to match their long-term goals. We designed the system to encourage more short- and long-term savings, while also decreasing high-interest rate debt. Want to send your kids to college? The platform makes it easy to create a separate savings account, with an automatic transfer from your checking account, that allows you to achieve your goal without having to think about it on a regular basis. By effectively removing all friction associated with putting money into a savings account, people are much more inclined to save.

Impact

We co-built a platform that removes the complexity from financial decision-making and delivers positive, personalized coaching one step at a time, while encouraging users to take a one-time action in order to get them closer to their financial goals. After building and testing live prototypes, the program was rolled out by a number of employers and advisors, including award-winning retirement advisory firms.

“From looking at our own data, we see how Moneymap’s scalable coaching gets employees to take meaningful financial actions,” said Moneymap CEO Matt Iverson.

Moneymap has scaled its impact further by creating a platform that connects qualified advisors with low- and moderate-income Americans, allowing advisors to easily provide pro-bono services. Moneymap secured funding from Prudential to continue this important work.

By applying behavioral insights and implementing low-cost interventions, we can remove the complexity from financial decision-making and help ensure positive financial results.