This project is a part of Duke’s Common Cents Lab and is generously supported by MetLife Foundation. This project was led by Irrational Labs’ Richard Mathera.

The Challenge

You want to buy a car. On your day off from work you go to a car dealership. The salespeople are really friendly and talk about how they’re going to help you out and get you into a car that you’ll fall in love with. You haven’t thought a lot about how much it’s all going to cost, but the salespeople tell you that with your credit you’re in luck–they can make the financing work and get you into the car of your dreams!

You’re over the moon.

But then you’re hit with the tax, title, and warranty. And the payments start and you realize insurance is more expensive than you thought, and you totally forgot to factor in repairs and maintenance (repairs so rarely happen!). Overnight your financial situation has become much harder than you originally bargained for, all because you forgot about some costs and trusted the bank would give you a loan you could repay.

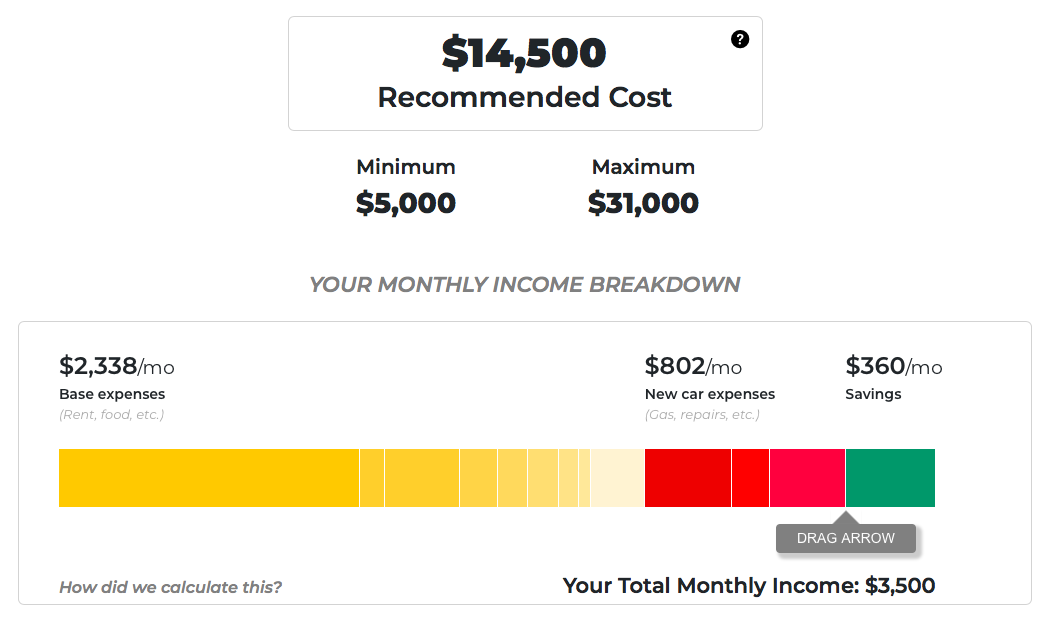

What if you had a tool that gave you a recommended amount to spend on a car based on your full financial situation and the hidden costs associated with car ownership? Most loan calculators only tell you how much you can spend if you had no other financial obligations or dreams (forget retirement, vacations, kids!). And the car calculators on the market today don’t include the real cost of car ownership. Would seeing the real cost of a car change the amount you spend on it? We created a calculator that tells you just that. And we tested it. And it does.

Hypothesis

Of the relevant auto-buying psychologies, we hypothesized that we could best design for anchoring and inattention/forgetting.

- Anchoring is a bias we fall victim to when we rely too heavily on an initial piece of information or number. Car buyers are often anchored not only to high car values at auto lots but also anchored by banks to the maximum they can borrow, likely driving up the price of the vehicles they buy.

- People also forget about many car-ownership costs because these costs are variable in terms of timing and amount (e.g. maintenance & repairs, gas, insurance, taxes, title, etc.). These car-ownership costs are often also famously hidden, especially at the time of the sale, making driving and buying a car seem less expensive than it actually is.

Process

We randomized a group of over 1500 people on Mechanical Turk into two conditions: one that went through our auto loan calculator and one that didn’t.

We additionally randomized people into one of three reflection conditions in an attempt to prime different levels of forethought about car costs:

- A no reflection group

- A general reflection on car ownership group

- A group that went through a reflection specifically focused on the costs of owning a car.

At the end of the process, we asked participants what price they would aim for when purchasing a car.

Result

The group that didn’t use the Auto Loan Calculator targeted buying a car for about $15,000, while those that went through the Auto Loan Calculator estimated they would look for a car that costed $12,500, a full $2,500 less.

Why did the Auto Loan Calculator work? We found that providing a new anchor price for the car and reminding people of costs they may have forgotten to consider were critical components of its success.

More specifically, the Auto Loan Calculator increased the rate at which people remembered different costs and increased their estimates of the costs of repairs & maintenance, gas and insurance. Participants in the cost reflection group were also more likely to remember also showed increased rates of remembering different costs and consequently the associated cost estimates.

Check it out here: https://autoloancalculator.commoncentslab.org/